DSM-Firmenich's January 2026 partnership with Hardeman Egg Group and Royal Agrifirm Group to produce "sustainable eggs" at price parity represents something more significant than another corporate sustainability announcement: it's a channel strategy dressed in green credentials, and it's working.

The Partners and What They Bring

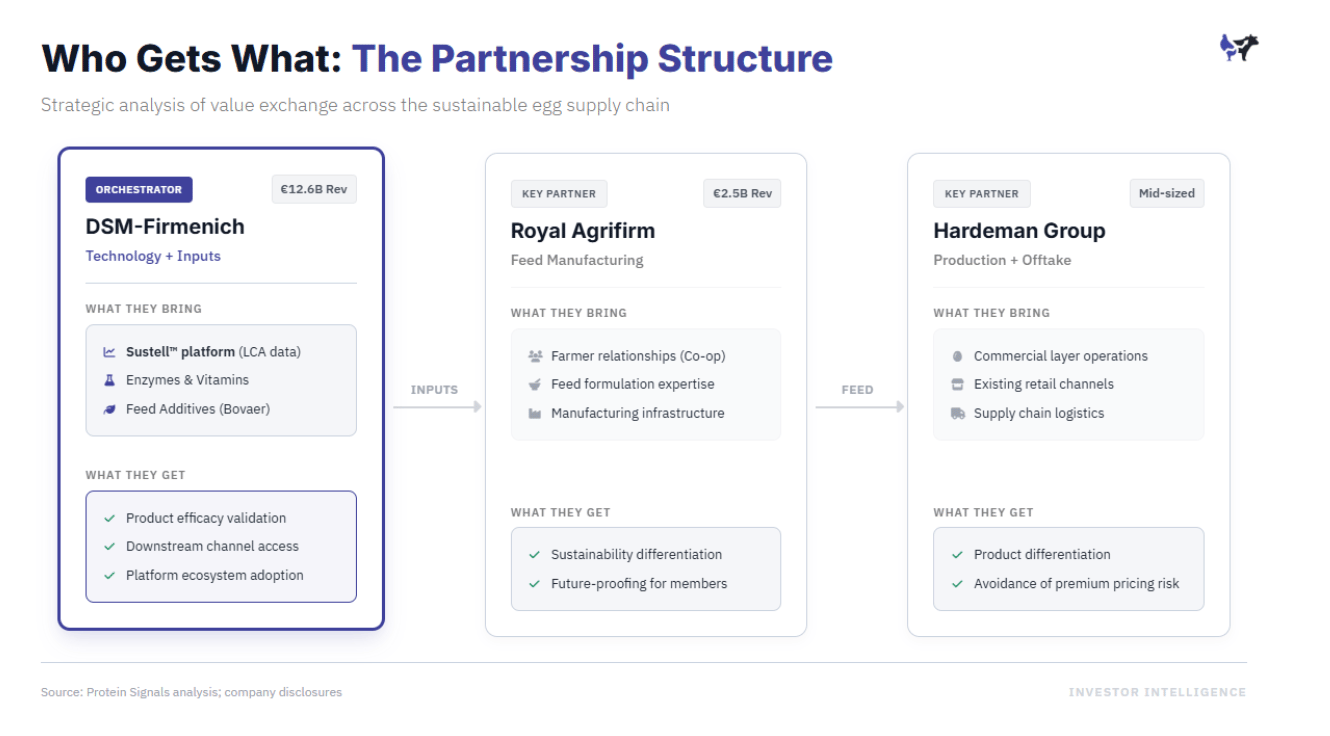

The structure is deliberate. DSM-Firmenich, the Swiss-Dutch ingredients giant with €12.6 billion in annual revenue, contributes Sustell (its carbon accounting SaaS platform) and the nutritional solutions portfolio—enzymes, vitamins, and feed additives - that drive the emission reductions. Royal Agrifirm Group, a €2.5 billion Dutch agricultural cooperative, operates as the feed manufacturer and farmer-facing distribution channel, formulating and delivering the optimized rations to layer operations. Hardeman Egg Group, a mid-sized Dutch egg producer, provides the commercial-scale production environment and offtake pathway to retail. Each partner occupies a distinct position in the value chain: technology and inputs, feed manufacturing and farmer relationships, and production scale. The arrangement allows DSM-Firmenich to demonstrate real-world emission reductions using its products while Agrifirm strengthens its sustainability positioning with cooperative members and Hardeman differentiates its eggs without absorbing premium pricing risk.

The partnership's most revealing insight isn't the claimed 17% carbon reduction - it's the explicit rejection of premium pricing. "There are already far too many options on the shelves," Hardeman CEO Ton Gielen stated. "If a consumer sees two cartons at the same price, they'll pick the verified lower-footprint option."

This contrasts sharply with European premium egg economics. Organic eggs command 120-130% premiums over conventional alternatives; free-range carries 15-48% markups. Dutch pioneer Kipster sells carbon-neutral eggs at organic prices. Yet DSM-Firmenich's model deliberately targets price parity because the real customer isn't the consumer - it's the retailer seeking Scope 3 emission reductions without absorbing margin pressure.

The Netherlands provides ideal conditions for this approach. Dutch supermarkets eliminated caged eggs from retail shelves over a decade ago; roughly 90% of shell eggs sold are already from alternative systems. Albert Heijn, the market leader, has committed to 45% greenhouse gas reductions by 2030 and recently became the first retailer globally to share ingredient-level carbon footprints across 1,100+ products. The infrastructure for sustainability verification already exists; DSM-Firmenich simply plugged into it.

Feed Additives as Carbon Reduction Tools

The mechanism deserves scrutiny. Between 65% and 80% of a laying hen's carbon footprint comes from feed, primarily from the embedded emissions in soy and grain production. DSM-Firmenich's nutritional solutions—phytase enzymes, proteases, and microbiome modulators—attack this through improved feed conversion efficiency.

Phytases, which now penetrate approximately 90% of global poultry diets, release phosphorus that chickens cannot naturally digest. This reduces demand for mined inorganic phosphate supplements with their substantial extraction and transport emissions. Studies document carbon footprint reductions of 376g CO2-equivalent per kilogram of body weight gain when combining phytase and carbohydrase enzymes. Layer-specific data shows Bio-Mos and Bioplex mineral supplementation delivering 1.5-2.5% emission intensity reductions per kilogram of eggs.

The commercial pilot with Agrifirm demonstrated that these interventions improved layer performance while cutting emissions—resolving the typical sustainability trade-off where environmental gains come at productivity cost. If scaled across the Netherlands' 10 billion annual eggs, the partners estimate 180 million kilograms of CO2-equivalent reduction, matching the annual energy consumption of 70,000 households.

Sustell as Ecosystem Infrastructure

The partnership's strategic architecture reveals DSM-Firmenich's broader ambition. Sustell, their life-cycle assessment platform certified to ISO 14040/14044 by DNV, isn't merely a measurement tool—it's ecosystem infrastructure designed to become indispensable.

The platform's December 2025 Carbon Value Program launch connected ISO-assured footprint measurement with protocols for transferring verified emission reductions across value chains. Unlike competitors such as Cool Farm Tool (free but uncertified) or Alltech E-CO2 (Carbon Trust accredited but narrower scope), Sustell achieves its differentiation through third-party certification that satisfies the emerging regulatory requirement for substantiated environmental claims.

DSM-Firmenich has systematically integrated Sustell with competing feed formulation software - Format Solutions, Allix, BESTMIX - rather than building proprietary data collection hardware. Partnerships with FarmTrace automate farm-level data ingestion, while Deloitte provides implementation consulting and Bureau Veritas delivers verification services. This creates a platform play where Sustell becomes the "operating system" for animal protein sustainability, naturally favoring DSM-Firmenich products but not exclusively tied to them.

The Regulatory Tailwind Accelerating Adoption

The timing aligns with regulatory convergence that makes carbon accounting increasingly mandatory rather than optional. The EU's Corporate Sustainability Reporting Directive requires Scope 3 emissions disclosure for large companies, with full implementation reaching listed SMEs by 2026. Since 75-90% of food and beverage company emissions typically fall within Scope 3, agricultural suppliers face cascading data requests regardless of their own reporting obligations.

More immediately, the Empowering Consumers for Green Transition Directive takes effect September 2026, banning generic environmental claims like "eco-friendly" or "climate neutral" without substantiation. Companies making sustainability assertions will require verified data - exactly what ISO-certified platforms provide.

The Green Claims Directive, which would have mandated third-party verification of environmental claims, was withdrawn in June 2025 amid concerns about SME burden. But the direction remains clear. Carbon accounting in agriculture is transitioning from competitive differentiation to table stakes for market access by 2030.

The Majors are Late to Layers

Cargill's BeefUp Sustainability Initiative and ADM's regenerative agriculture programs focus predominantly on beef and row crops, leaving layer-specific partnerships to smaller players. Nutreco joined the FAO's Livestock Environmental Assessment Partnership in 2025 but lacks DSM-Firmenich's integrated measurement-to-intervention offering. The Dutch partnership represents first-mover advantage in a segment where major feed companies remain underweight.

The competitive moat isn't the eggs - it's the verification infrastructure. Early data suggests Sustell's user base is growing as food companies prepare for CSRD compliance deadlines and retailers demand Scope 3 data from suppliers. Each integration strengthens network effects; each verified claim builds switching costs.

Measurement as Market Capture

DSM-Firmenich has constructed something more durable than a sustainable egg brand. By positioning Sustell as essential infrastructure for agricultural carbon accounting, bundling measurement with nutritional interventions that demonstrably reduce emissions, and launching commercial proof points with established Dutch producers, the company has built a system where measuring sustainability creates demand for their products that improve it. The eggs are merely the first scaled application of a platform designed to become indispensable across the €450 billion global animal nutrition industry.