On February 3, 2026, Zoetis launched the first commercial genetic predictions for bovine respiratory disease. In plain terms: beef producers can now read a calf's DNA and get a score predicting whether that animal is likely to stay healthy in the feedlot or get sick and die. Nobody else sells this.

BRD, often called "shipping fever," is a respiratory illness that costs the U.S. beef industry roughly $1 billion a year. It accounts for 75% of feedlot sickness and up to 75% of feedlot death. Decades of vaccines, antibiotics, and management changes have not reduced its incidence. The disease keeps winning.

Zoetis is betting that genetics can shift the odds.

What the Product Actually Does

The new predictions come as an upgrade to Zoetis's existing INHERIT genetic testing platform. Producers get three new scores: one for BRD health (will the calf stay healthy after weaning?), one for BRD survival (will it live through the feeding period?), and a combined dollar index estimating economic impact per calf.

Zoetis's headline claim: bulls in the top 25th percentile for the $BRD index have a $1,200 predicted advantage over bottom-quartile bulls across 100 lifetime calves. The predictions were validated against more than 440,000 tested commercial animals.

Does the Science Hold Up?

The short answer: moderately. The longer answer matters.

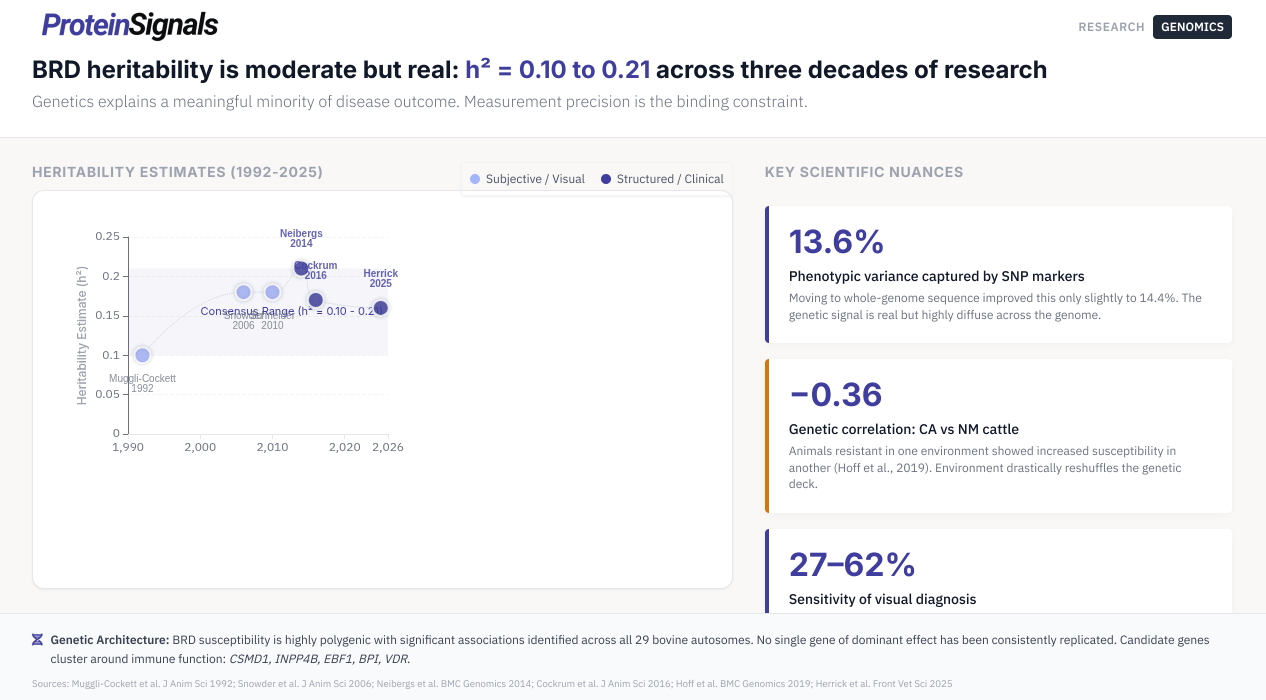

Heritability estimates for BRD susceptibility range from 0.04 to 0.21 in peer-reviewed literature. That range is itself telling. Lower estimates come from studies relying on subjective visual diagnosis (pen riders watching for sick calves). Higher estimates come from studies using structured clinical scoring systems. The measurement problem is real: visual BRD diagnosis has a sensitivity of just 27 to 62%, meaning a large share of cases go undetected.

Study | Population | Heritability |

Muggli-Cockett et al. (1992) | 10,142 beef calves | 0.10 |

Snowder et al. (2006) | 18,112 feedlot calves | 0.18 (liability scale) |

Neibergs et al. (2014) | 2,781 Holstein calves | ~0.21 |

Cockrum et al. (2016) | 2,869 crossbred steers | 0.17 |

Herrick et al. (2025) | 9,384 Holstein heifers | 0.16 |

A heritability of 0.15 to 0.20 means genetics explains a meaningful but minority share of whether an animal gets sick. Environment, management, pathogen exposure, and stress do most of the work. This is not a binary on/off switch. It is a nudge applied across thousands of animals and compounded over generations.

The genomic architecture is stubbornly polygenic. No single gene of large effect has been consistently identified. Significant associations scatter across nearly all 29 bovine autosomes. One study found that even 770,000 SNP markers captured only 13.6% of phenotypic variance. This is classic quantitative genetics territory: many genes, small individual effects, meaningful aggregate signal at population scale.

The most concerning finding comes from Hoff et al. (2019), who reported a genetic correlation of negative 0.36 for BRD susceptibility between California and New Mexico cattle. Animals genetically resistant in one state showed increased susceptibility in the other. Different pathogens, different environments, different genetic architecture. Prediction models trained in one ecology may not transfer cleanly to another.

Where the Competitive Moat Actually Sits

The science is imperfect. The moat is a work in progress…

Zoetis built its BRD predictions on feedlot health phenotypes from over 50,000 head of commercially representative cattle, embedded in a reference population exceeding 1.4 million animals. Academic studies that laid the scientific groundwork typically used hundreds to low thousands. The scale difference is one to two orders of magnitude.

This phenotype dataset is the asset that matters. Collecting feedlot health records at scale requires years of relationship building with commercial operations that sit outside breed association recording systems. No breed association currently offers BRD predictions or any comparable infectious disease trait. Neogen's Igenity Beef platform covers 17 production traits but nothing for respiratory disease. The closest competitive move was Neogen's February 2025 launch of a bovine congestive heart failure risk test, a different category entirely.

Replicating what Zoetis has would require a competitor to simultaneously build the phenotype pipeline, the multi-breed evaluation engine, the genotyping infrastructure, and the commercial distribution network. Zoetis fields approximately 4,050 sales representatives across 100+ countries.

The Data Flywheel is the Long Term Real Strategy

The BRD launch is best understood not as a standalone product but as the latest turn of a compounding data cycle. More producers test. Testing generates proprietary genotype and phenotype data. More data improves prediction accuracy. Better predictions attract more testing.

Zoetis's dairy genomics franchise demonstrates the pattern. When CLARIFIDE launched in 2010, roughly 45,000 U.S. dairy animals were genotyped annually. Today the figure approaches 40,000 per month.

The company has been deliberately narrowing its livestock portfolio toward proprietary biology-data assets:

It divested its medicated feed additive business to Phibro in October 2024, explicitly stating it would "focus investments on areas with the highest growth potential," naming genetic programs among the priorities.

It acquired and then divested Performance Livestock Analytics, pulling back from general-purpose farm software to concentrate on genomics and diagnostics where its data advantages compound.

What to Watch

Whether the BRD predictions deliver sufficient accuracy to change on-farm outcomes at scale remains an open empirical question. Moderate heritability, severe genotype-by-environment interaction, and noisy phenotyping impose hard limits.